Preparing Financial Business Statements

Content

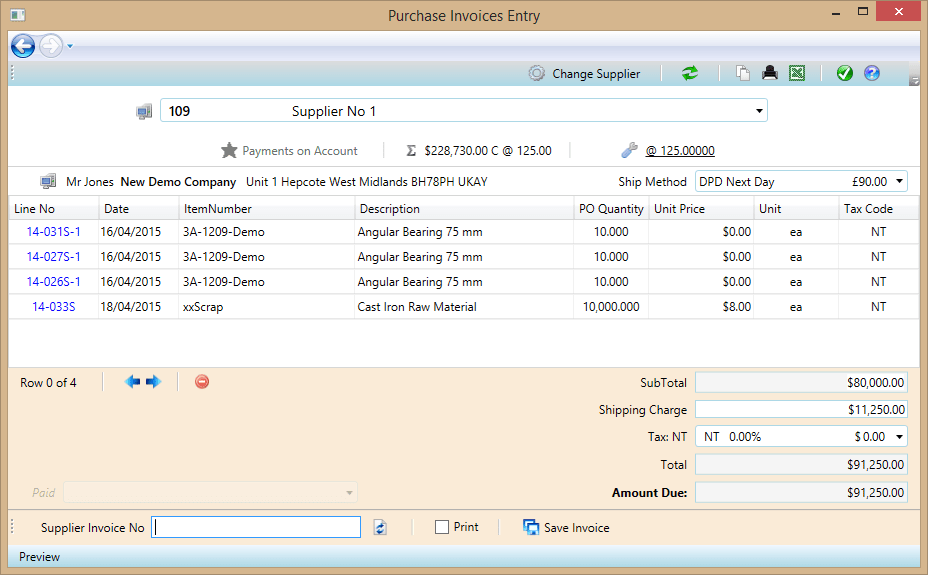

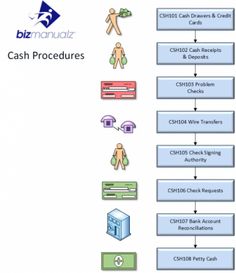

Accrue an expense for any wages earned but not yet paid as of the end of the reporting period. Compare the shipping log to accounts receivable to ensure that all customer invoices have been issued. Compare the receiving log to accounts payable to ensure that all supplier invoices have been received. Accrue the expense for any invoices that have not been received.

One way of explaining the balance sheet is that it includes everything that doesn’t go on the income statement. The balance sheet lists all the assets and liabilities of the business. For example, assets include cash, accounts receivable, property, equipment, office supplies and prepaid rent. Liabilities include accounts payable, notes payable, any long-term debt the business has and taxes payable. The income statement is one of the most important types of financial statements.

Shareholders’ Equity

Moreover, if the accountant prepares financial statements for the same client, independence is not required. Signing checks, bookkeeping, and the preparation of financial statements are all nonattest services. Looking at the asset section of the balance sheet, Accumulated Depreciation–Equipment is included as a contra asset account to equipment. The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the book value of equipment ($3,425). The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity. An income statement shows the organization’s financial performance for a given period of time. When preparing an income statement, revenues will always come before expenses in the presentation.

Once expenses are subtracted from revenues, the statement produces a company’s profit figure called net income. The cash flow statement provides business owners with details on incoming cash as well as outgoing cash, and can help you calculate important metrics such as operating cash How to Prepare Financial Statements flow. Whether you’re an experienced bookkeeper or still stumbling your way through accounting 101, financial statements are important. A company’s financial statements can give you a much better idea of how a business is performing than by simply looking at its revenue and earnings.

Financial Statement Preparations

During the reporting period, the company made approximately $4.4 billion in total sales. It cost the business approximately $2.7 billion to achieve those sales. If you prepare the income statement for your entire organization, this should include revenue from all lines of business. If you prepare the income statement for a particular business line or segment, you should limit revenue to products or services that fall under that umbrella. When it comes to financial statements, each communicates specific information and is needed in different contexts to understand a company’s financial health. The income statement also shows any revenue during the time period in question from assets, such as gains on sales of equipment or interest income. In Completing the Accounting Cycle, we continue our discussion of the accounting cycle, completing the last steps of journalizing and posting closing entries and preparing a post-closing trial balance.

The requirements for audit or review of Financial Statements will vary depending on the structure of the organization and the revenue of the organization. Once the amounts of each category are determined, they are combined by taking the sum or difference https://business-accounting.net/ of the total amounts to get the net increase in cash or net decrease in cash . So, if I add all those up, that means all the cash that I got from my customers was $2640. In the statement retained earnings, it’s still for the year ending December 31st.

— Posted on April 28, 2022 at 8:27 am by permagroove