What are Selling, General, & Administrative Expenses?

Content

These expenses can also be referred to as overhead and include rent, utilities, insurance, salaries such as accounting and human resources, technology, and supplies other than those used in manufacturing. SG&A includes most other costs related to running a business aside from COGS. These costs are not related to specific products, so they are categorized separately from the cost of goods sold on the income statement. SG&A expenses are sometimes referred to as period costs since they relate to the time period in which they are incurred, and they do not relate directly to production. The only real difference between operating expenses and SG&A is how you record them on the income statement. Some businesses prefer to list SG&A as a subcategory of operating expenses on the income statement. Other companies may prefer to separate selling expenses from the G&A costs on the financial statement instead.

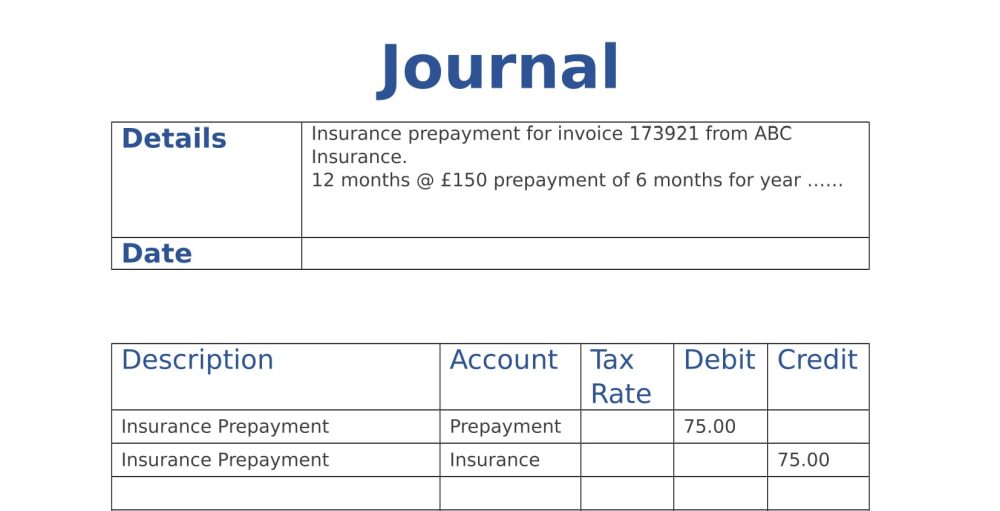

- SG&A costs include any expenses related to the operation of the company but not directly linked to producing and delivering its products.

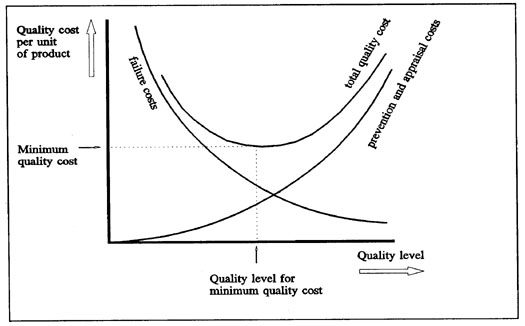

- Firms with highly variable cost structures are said to have low operating leverage.

- Whether indirect or direct selling costs, general expenses like rent and utilities, or administrative costs like salaries and legal fees, SG&A costs are essential.

- SG&A also excludes research and development (R&D) costs, as well as depreciation and amortization, which are different categories of operating expenses.

- The expenses include running the business and providing its goods or services.

- At the same time, companies need to act wisely in making these decisions.

Because of this, a management team hoping to increase revenues rapidly will find it an easy target. To simplify today’s post, we will refer to selling, general & administrative expenses as SG&A going forward. Selling, general & administrative expenses have changed over the years.

Want More Helpful Articles About Running a Business?

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, Selling General And Administrative Expense Sg&a and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

It may be broken out into a number of expense line items, or consolidated into a single line item . Direct https://online-accounting.net/ selling expenses are incurred only when the product is sold and are related to the fulfillment of orders.

Selling, general and administrative expense definition

Some expenses, such as interest expense or tax expense, are reported below operating income. The selling, general and administrative expense (SG&A) is comprised of all operating expenses of a business that are not included in the cost of goods sold. Management should maintain tight control over these costs, since they increase the break even point of a business. SG&A appears in the income statement, below the cost of goods sold.

— Posted on March 1, 2021 at 9:05 am by permagroove